Online Sports Betting Industry: Market Statistics & Predictions till 2029

- Author:Nikita Ajmani

- Read Time:7 min

- Published:

- Last Update:August 23rd, 2024

Table of Contents

Toggle

Sports Betting in the iGaming Industry: A market finally getting its dues!

Table of Contents

ToggleExisting for over a century in various parts of the world, creating examples with both positive and negative impacts, sports betting has been on record for all reasons. From kings betting on horse racing in ancient times to modern-day sports betting on football and cricket, the unregulated market has continually evolved.

Considering the gaining popularity and thrill associated with sports betting, the U.S. government took a timely decision to legalise it and make it taxable in the year 2018. Since then over 35 U.S. states have legalised betting in their respective states to earn taxes from this long-functioning yet non-regularised industry.

On the contrary, online wagering in iGaming has seen slower growth with only 6 states legalizing iGaming with others considering legalization since 2011, the year iGaming was legalized.

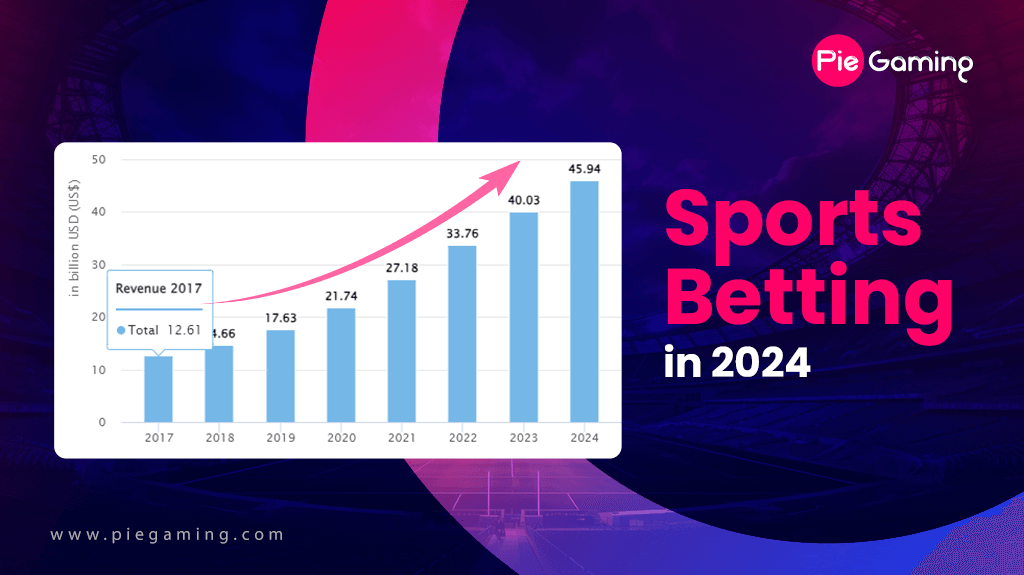

Research reports from Statista confirm the following details:

- Revenue in the Online Sports Betting market is projected to reach US$45.94bn in 2024.

- Revenue is expected to show an annual growth rate (CAGR 2024-2029) of 7.41%, resulting in a projected market volume of US$65.68bn by 2029.

- In the Online Sports Betting market, the number of users is expected to amount to 180.8m users by 2029.

- User penetration will be 3.9% in 2024 and is expected to hit 4.9% by 2029.

- The average revenue per user (ARPU) is expected to amount to US$0.33k.

While figures speak great volumes, let us understand how it is happening.

Online sports betting and iGaming have diversified and enhanced the industry by creating fresh opportunities for players and attracting more players from previously untapped consumer segments and demographics. This has eliminated the concerns of digital cannibalization among legacy brands.

U.S. Commercial and land-based casinos saw a growth of 8% in their revenue alongside 55% increase in the revenue for iGaming and sports betting in the year 2022. It is said to be well above their long term average.

While the TAM (Total Addressable Market) is still emerging but is seeing rapid growth. TAM for iGaming and sports betting is expected to reach $ 40 billion by 2030 and potentially capture some of the illegal betting markets. The Americal Gaming Association estimates it to involve around $400 billion in annual wagers and generates somewhere around $17.3 billion roughly in revenue.

Overcoming the Sports Betting Growth Hiccups in the Year 2022-2023

Despite the rapid growth in the sports betting and iGaming sector in the years before 2022-23, most operators remained unprofitable. The industry lifecycle demanded operators to make huge investments to win over newer markets and gain profits. Entering new geographies and acquiring players was costly in terms of promotion, market access and spendings on marketing. It took them years to see a positive growth on the graph.

Till the year 2022, some of the top operators recorded a negative EBITDA of $2.5 billion in a year. This excluded capital expenditure and asset acquisition costs. Flutter, the parent company of FanDuel, in November 2022 reported that they had invested a whopping $5.8 billion in FanDuel between their initial acquisition in 2018 till June 2022. Finally, between 2022-23, profitability started moving positively and adjusted their EBIDTA losses with an estimated $1.6 billion.

Market Concentration with Top Operators and Its Impact

In the U.S. Market, top operators already own 70% of the market and are growing at around 5% year on year, leading to squeezing the opportunities for new entrants. It is expected that the market will further polarize between these large players and everyone else.

While there is always a struggle for new entrants to explode the market, but it is never impossible for one to find its own niche. It is critical here to understand that no matter who dominates the market, consumers are always interested in finding out more options that directly benefit them.

Pro Tip: Look for the gap in the supply chain, find a solution, and hit the market with the right marketing plan to gauge eyes, interest, and plays.

Read Blog – How To Create Your Own Sports Betting Platform?

Path to Profit in the Never-Ending Sports Betting Industry

Despite the enormous difficulties and challenges, the path forward for the sports betting and iGaming industry is glorious. With scalability, market maturity, new geographies, and exploring opportunities with the changing consumer trends market is expected to rise and flourish.

To achieve the above goal, operators need to discipline their operational activities, watch their spending, and balance their customer acquisition cost versus their lifetime value. This can be achieved by focusing on ROI driven marketing and sales strategies..

Long-term growth involves sustainability and making the right, well-thought decisions from the beginning. Let us now discuss what new-age operators can do to mark their presence in the ever evolving sports betting and iGaming industry.

-

Build thoughtful, differentiated, and unique sports betting software

Create personalized experiences. Consumers in any market expect personalization. This elevates your sports betting and iGaming business to a level further. With so many operators competing, it is quick for users to switch loyalties when their demand is not met. As a sportsbook operator, you can borrow strategies and content from social media, understand consumers’ liking, and pitch relevant events and games in real time to increase penetration and retention on your sports betting software.

With the help of AI-based solutions available in the market, you can tweak your offerings, focus on gamification, improve odds, enhance UI/UX and improve players’ journey on the software.

-

Cross Sell between Sports Betting and Online Casinos

While sports betting in itself is highly profitable, staying stranded with just one offering will limit you to widening your horizon to a bigger player base. It is crucial to understand here that players who gamble would not necessarily gamble on sports. Some might like casino games as well. It is for this reason that casino games have existed for a long time. Therefore, to add more customers and strategically improve ROI, cross-sell. Integrate an online casino solution with your online sports betting software to offer more categories in the same platform.

Another benefit here to consider is that your costs are cut to half for marketing, acquisition, retention, and infrastructure, while profit margins are doubled. Additionally, iGaming does not need intensive occasional promotions like sports events and can be easily carried throughout the year without the fear of downtime. This can stabilize your revenue on your sports betting software and keep you profitable round the year.

-

Focus on customer retention alongside acquisition

While customer acquisition plays a large part in helping a sports betting platform grow, customer retention is also equally important. Understand the simple fact that each customer acquired has come through certain costs involved in marketing and promotions. You can not, as an operator, make the acquired customer go away quickly. It becomes even more crucial for sportsbook operators to give a unique betting and gaming experience to players to keep their interests gauged and increase their spending on sports betting software.

-

Be a Strategic Marketer to outstand

Carving your niche and presence in this highly competitive iGaming industry is not an easy walk. Apart from the amount you’re willing to spend on marketing and branding, it is advised to carefully analyze your plans to decide your spending. Follow the below mentioned steps to ensure you’re able to count every penny spent and ROI against it.

- Review your players’ activities and behavior on your sports betting platform

- Divide players with similar interests into smaller chunks

- Define the marketing strategies for players and agents

- Devise your promotional campaigns

- Execute plans separately for each category like mailers, offers, bonuses, social media promotions

- Consider separate budgets for each promotion

- Roll out your campaigns and track them

- Analyse spending versus ROI

Finally,

The sports betting market is one part of the universe of wagering, playing a critical role in shaping the entertainment and iGaming industry today. It has proved to be a story of innovation, engagement, and the ever evolving relationship between fans, their favorite sports, and technology. As sports betting continues to evolve at a similar speed, it surely is here to stay and capture wider audiences in the years to come.

FAQs

-

What is sports betting?

Sports betting is the act of placing bets on a given sports event happening at that time. Players , also known as punters, place bets in the various betting markets (or categories) offered by operators on the sports betting software. It keeps the game exciting and punters hooked throughout.

-

What are the types of software for sports betting for operators?

Budding and experienced operators in the evolving markets of online sports betting have three main sports betting software options: a white-label betting platform, turnkey sports betting software, and custom software. Each of these software options can be easily chosen depending on your requirements, budgets, and scope of growth.

-

How does online sports betting works?

Online sports betting involves placing wagers on sports events through online platforms, also known as, sports book software. Generally users start by picking an online sportsbook software of their choice, create an account, and deposit funds. Later, they select the sports they want to bet on, pick the bet type, and place bets. Live betting on online betting platforms allow players to even cash out early and keep them interested and involved for a longer time.

Nikitaa Ajmani is a passionate writer at PieGaming, specializing in exploring the dynamic world of iGaming. With a keen interest and 5+ years of experience in technology and gaming, Nikitaa offers insightful analysis and information about the industry. Dive into the world of iGaming with Nikitaa to uncover the latest trends and innovations in the industry of online gaming.

-

Palak Madan August 9, 2024

Palak Madan August 9, 2024Discover the top 10 sports betting software providers in 2024. These providers offer user-friendly features and customizable solutions, transforming the sports betting landscape…

-

Simranjeet Kaur July 5, 2024

Simranjeet Kaur July 5, 2024In the high-stakes sports betting world, fortunes can be made or lost as a result of a single match outcome. But what if…

-

Simranjeet Kaur May 28, 2024

Simranjeet Kaur May 28, 2024By 2028, the total revenue from the global sports betting market is expected to hit USD 129.3 billion By the end of 2025,…

-

Simranjeet Kaur May 14, 2024

Simranjeet Kaur May 14, 2024Let’s understand sports betting and odds in sports betting, how they are calculated, and how as a beginner, you can read them.

-

Nikita Ajmani April 4, 2024

Nikita Ajmani April 4, 2024In 2024, the horizon of sports betting continues to expand rapidly. It is driven by technological advancements, shifting regulatory frameworks, and changing consumer…

-

PieGaming Staff March 6, 2024

PieGaming Staff March 6, 2024Discover the top features of sports betting sites with our comprehensive checklist and ensure your platform stands out in a competitive environment.

-

PieGaming Staff February 8, 2024

PieGaming Staff February 8, 2024Know about White Label Betting Exchange Solutions including its features, benefits, and the reasons it has become the go-to choice for many in the market.

-

Nikita Ajmani February 1, 2024

Nikita Ajmani February 1, 2024Elevate your online sports betting experience with white label solutions that optimise user engagement and provide a seamless platform for wagering.

-

PieGaming Staff January 31, 2024

PieGaming Staff January 31, 2024Discover the top 6 tips for selecting reliable turnkey betting platform providers to enhance the betting experience for your customers. Click to read now.

-

PieGaming Staff January 16, 2024

PieGaming Staff January 16, 2024Here’s the list of the leading 5 whitelabel sports betting exchange providers worth exploring. Note their exceptional services & offerings setting them apart.

-

PieGaming Staff December 30, 2023

PieGaming Staff December 30, 2023Every individual in the 21st century considers developing a business that can provide ripened fruits. If you are up to the same goals,…

-

PieGaming Staff December 6, 2023

PieGaming Staff December 6, 2023Analysts all over the world have been noticing a sudden increase in the revenue of the global sports betting market in the past…

Voila!

See you in your inbox soon!

Stay ahead of the game. Subscribe for exclusive content, updates, and insiders!

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.